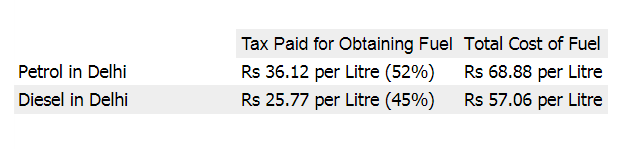

Oil prices almost rock bottom for last three years and petrol /diesel at it maximum! Still unsupported global factors? Additional taxes currently constitute 45%-52% of the retail price of auto fuels in India.

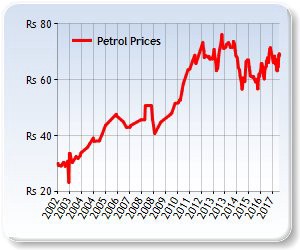

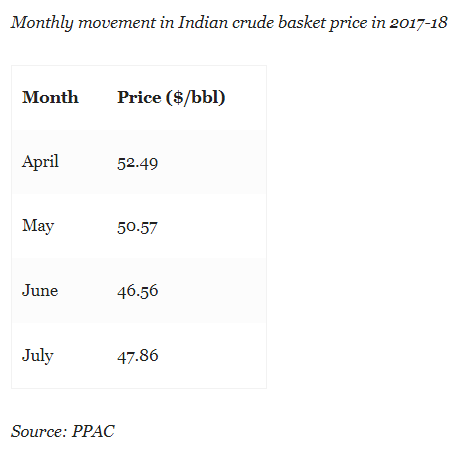

The Centre collects approximately INR 2,42,000 crores from Taxes on Fuel from only Rs. 70,000 crores in 2014. And, in 2017, off late the prices have increased by around 8% to 10% in last few months in India.

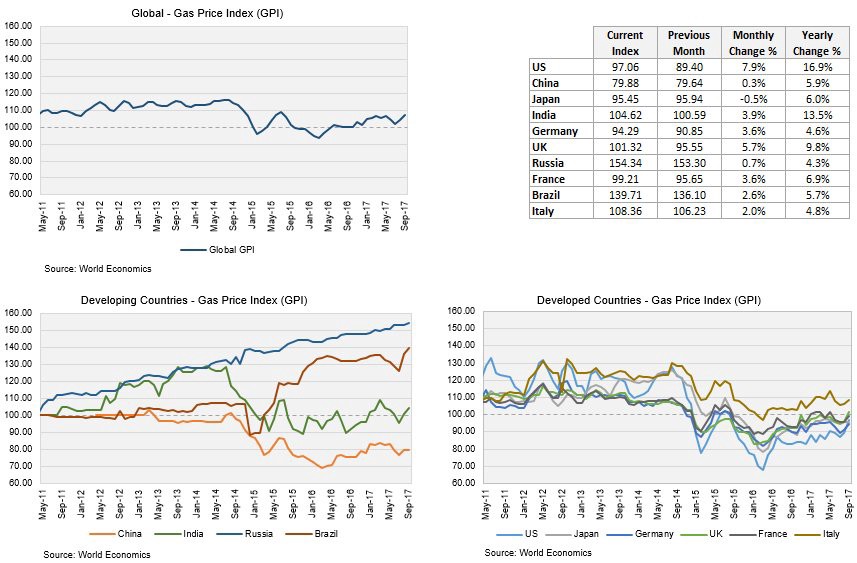

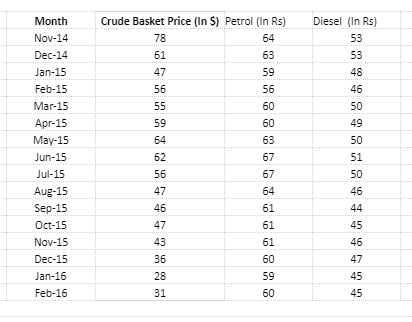

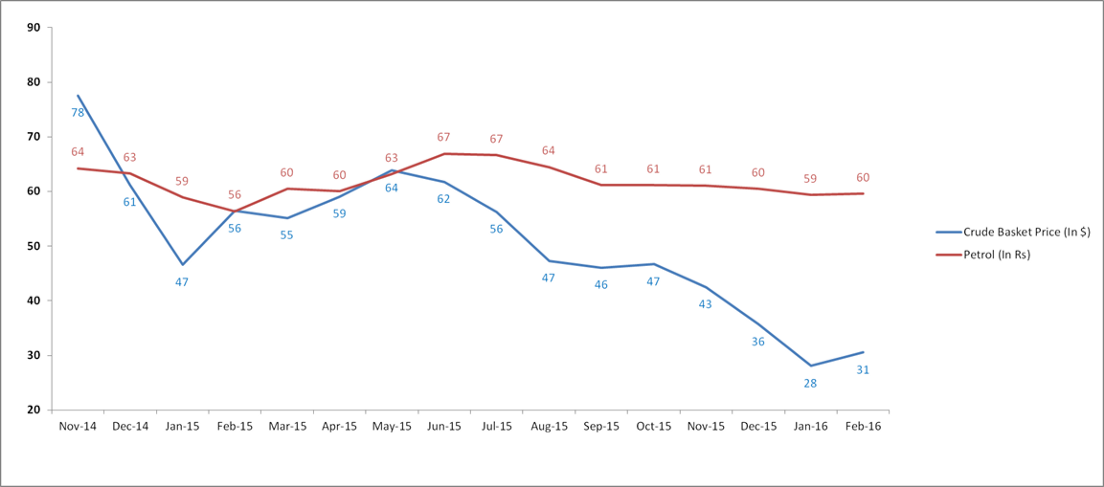

Indian fuel is officially costliest now as per any International standards. Petrol prices are nearly 10% higher since July despite global prices remaining stable? Crude oil prices are down 55.5% since June 2014 but petrol prices in India are cut only by 9.8%.

Why is that Indians do not benefit from global pricing?

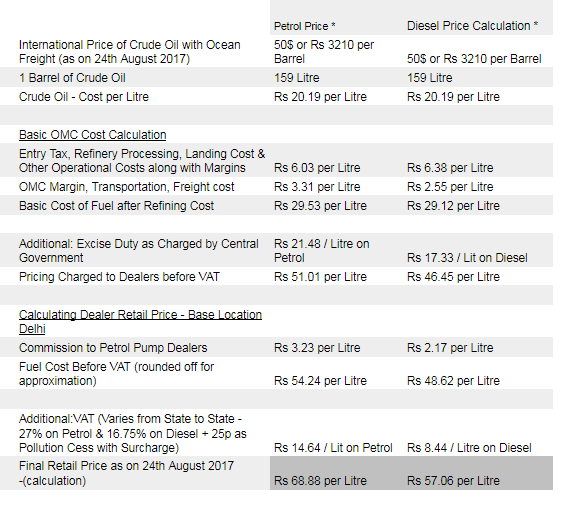

From INR 63.09 when GST was announced — Petrol prices increased to INR 68.88 per litre. The same effect on what was INR 53.33 Diesel in increased to INR 57.06 per litre in just 1 month period.

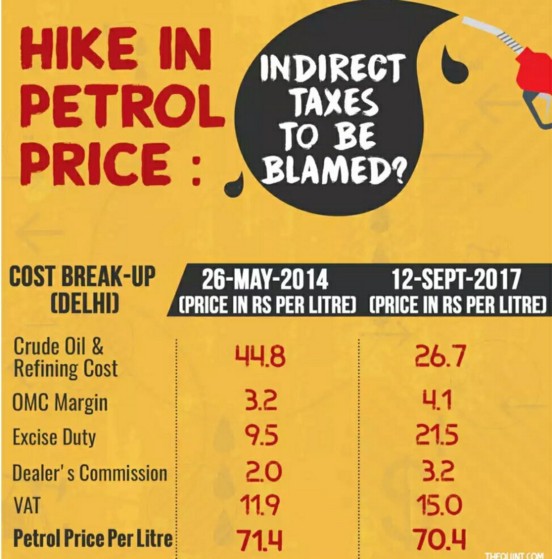

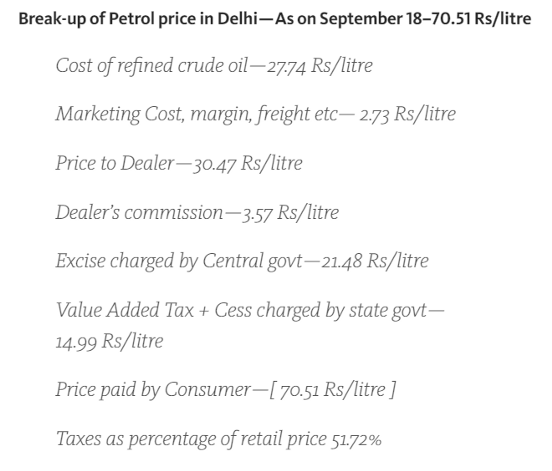

According to data released by the Indian Oil Corporation, petrol costs only INR 27.77 per litre at refineries. The refineries sell it to the dealer at INR 30.48. And, the dealer sell sit to the final consumer at INR 70.52 a litre. The final price includes Excises Duty (INR.21.48), VAT (INR.14.99) and dealer’s commission (INR.3.57) As of 21st Sept, 2017.

The bone of contention is that no govt in power really ever wants to reduce its social sector spending. It does not want to reduce any money on infrastructural CAPEX spends.

Petrol fuel and diesel prices were selling at INR 53.47 and INR 39.69 a litre respectively in Sri Lanka, nearly 23% and 30% lower compared to India.

In Nepal, retail prices of petrol fuel and diesel fuel prices were 12% and 19% respectively lower than rates of auto fuels in India on the same day.

In Bhutan, selling price of petrol fuel was nearly 10% lower, though difference in diesel was less pronounced at 1%.

Obtaining Fuel by paying taxes, is not much different in other cities unlike the stats as in Lutyens — And, its almost similar or even higher taxes charged.

It means for every litre of fuel you are filling in the Capital, you are ending up paying a steep tax of INR 36.12 per litre. And, its quite high in other states.

“As the crude oil price has declined in the past 3–4 years, to protect the revenue returns, Central excise and VAT have been increased. That is the reason why the consumer is not getting the benefit though the crude oil price had declined,” the Minister said.

In Kerala, VAT on petrol was 26% in 2014 and 34% now. Central excise had also increased. While VAT on diesel was 20% in 2014, it had touched 26.7 %.

… The prices continues to haunt for consumers who never get the direct benefit. Let alone politics play with the array of profit mongering oil re-marketers!

Need help with Digital Marketing? Try KEYSOME

Need help with Digital Marketing? Try KEYSOME