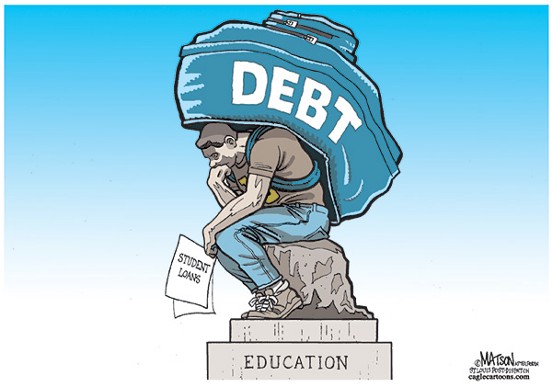

No one contest the fact that getting a college degree is an expensive untertaking. Although the government provides several federal student loan programs to help prospective students to complete their educations, federal student loans have annual borrowing limits. For students without financial aid or assitance from family members, the cost of classes, books, and housing can easily surpass the lending limits. Private student loans can help students make up for the deficiency and complete their educations. Private student loans, however have different requirements and qualifications than federal loans that educated borrowers must consider before applying.

Credit check

Private student loans often require a credit check. This presents a problem for some borrowers. Many college students are young and have not had a time to build a sufficient credit history. A portion of each consumer’s credit score is dependent upon the length of his credit history. Therefore, some college students either won’t qualify for private student loan or won’t qualify for a low interest rate.

Acquiring a co-signer is one way of getting around the credit reuirements of private student loans. A co-signer agrees to take on the responsibility of repaying the loan if the student defaults on his financial obligation to the lender. The lender takes the credit score and income of the co-signer into consideration when evaluating the private student loan applciation and determining the primary borrower’s eligibility.

Interest rates

Private student loans carry higher interest rates than federal loans. When it comes to interest, very few private student loan lenders can compete with the federal government. Federal student loans come with interest rates much lower than the industry standard to falicitate repayment and help borrowers compelete their education.

A private lender has little motivation to offer student loans other than the prospect of making a profit. As a business model, this is perfectly acceptable. It does, however result in students paying higher interest rates on private student loans.

Terms of repayment

Private student loan repayment terms may be difficult to meet. Most student loan borrowers believe tht they don’t need to being repaying their loans until after graduation. In most cases, this is true. A private lender, however has the option to require a student to begin making payments towards his private student loan debt immediately. For some, the repayment terms can result in diffulty making paymenys and eventual default.

Deferrment and forbearance due to circumstances such as financial hardship and re-enrollment in college are optional for private lenders. This leaves borrowers with little recourse other than to default on their private student loans if they cannot afford the payments. The risk increases for an individual who either does not find employment immediately after graduation or makes a lower salary than he orginally anticipated when they apply for the loan.

Although private student loans can provide a beneficial boost to a student’s income to help them complete his education, and they aren’t suitable for everyone. Because all private student loans have different terms and conditions, prospective borrowers must thoroughly read and understand their loan contracts before agreeing to private education loan.

Need SEO for your website? Visit KEYSOME

Need SEO for your website? Visit KEYSOME