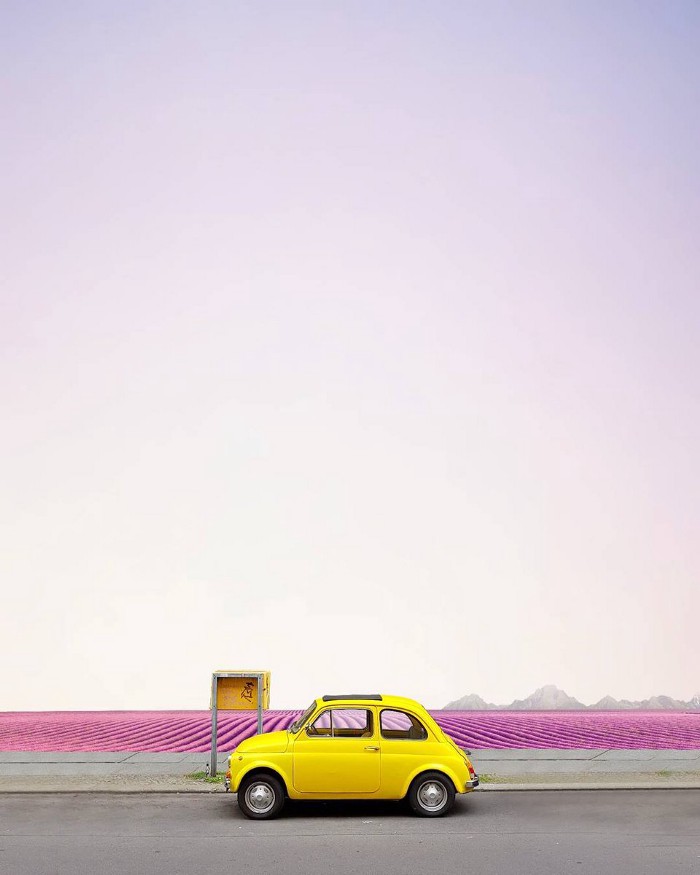

Before taking a trip outside the United States, It’s vital that you have the right credit card In your wallet Many countries in Western Europe, Latin America, and Asia are using twenty-first century credit-card technology, which the United States has yet to completely implement it’s important to be aware of this when you’re getting ready to take a trip outside the country. You can plan carefully for your overseas’ adventure only to have it ruined because you are carrying the wrong card. Before leaving the country, get a credit card that Is accepted abroad.

The holidays will be here before you know it, and now is the time to get started. tf you would rather start off the new year with a dean slate than a pile of old credit card bills, you need to do some smart planning — and control your holiday spending. Getting a handle on your holiday spending is not as difficult as you might think. You do not have to become a hermit or turn into the family Grinch to start off the new year debt-free. Here are 2 smart ways to optimize and control your holiday spending, so you can celebrate the season right.

Sell Off Last Year’s Gift Disasters

From the ill-conceived secret Santa gift from last year’s Christmas party to the ill-fitting sweater your Aunt gave you, there are probably lots of unwanted items cluttering tip your closet and taking tip space in your garage. If you act now, you can turn those gift disasters Into a solid holiday spending fund. Whether you sell your unwanted gifts online or set up a table on your front lawn, there are plenty of ways to turn those items into holiday spending cash. One person’s trash is another person’s treasure, and you may be surprised at how much you can earn.

Open a Separate Bank Account — One That Pays You Back

If you really want to know haw much you are spending, a separate bank account will help you do just that. You can fund your new bank account with the amount you want to spend and make your purchases from there. Better still, you can choose a bath account with a bonus, so you can start holiday shopping season in the black.

According to Smart Card Alliance, twenty-two countries have implemented EMV technology, while fifty others are in the process of transitioning over. EMV is an acronym for Europay, MasterCard and Visa, the three companies which devised the new technology. In the United States, credit cards still use the magnetic strip to store account Information. The magnetic strip has been around for about forty years, which In technological years Is a very long time. Instead of using a magnetic strip, the EMV card contains a microprocessor chip. A unique code Is formulated each time the card Is used, making it very difficult to steal the owner’s account information. A report published by Financial Fraud Action UK entitled “Fraud the Facts zoly” found that that since 2008, there has been a 75% decrease In credit-card fraud in Britain as a result of the new EMV technology.

Don’t depend on the Issuer of your credit card to make you aware of the problem. You must be proactive and do your own research. You may still be able to use your outdated card at some foreign destinations, especially those that cater to tourists, but you shouldn’t count on it. The irony is that some of the same Issuers that offer a card without foreign transaction fees don’t offer a card with an EMV chip. It’s great not to have to pay the transaction fees, but you won’t save a dime if you can’t use the card.

The best way to decide which credit card to use is to visit one or more of the websites that compare credit cards. According to ArthaMoney, the Chase Sapphire Preferred card and the Bank America Travel Rewards card use chip technology and offer no foreign transaction fees. Bank of America doesn’t charge an annual fee to use its card, whereas If you use Chase’s card, you’ll pay $95 yearly.

With both cards you can earn bonus points If you spend a set amount over the first three months you own the card. You can use these bonus points to defray the cost of airfare, hotels,and rental cars Additional examples of cards with EMV technology include Chase Bank’s British Airways Visa Signature card and the Marriott Rewards Premier card. Citibank also offers EMV cards, such as the Hilton H Honors Reserve card and the Platinum Select A Advantage World Mastercard.

Even if you still carry your current card with you, It’s imperative that you apply for an EMV card. Unfortunately, there a number of things you can’t control when travelling. However, with the right credit card, you’ll have the peace and security of knowing that wherever you go, you can pay for the things you need and want.

Need SEO for your website? Visit KEYSOME

Need SEO for your website? Visit KEYSOME